Investing early and consistently is like planting a tree; the sooner you start, the larger it grows. Imagine a young person just entering their career. They’re likely focused on getting their financial footing, paying off any student loans, and maybe starting to think about bigger goals like a house or retirement. But let’s not underestimate the impact of starting to invest even small amounts early. It’s honestly one of the best moves you can make for the future-you. Here’s why.

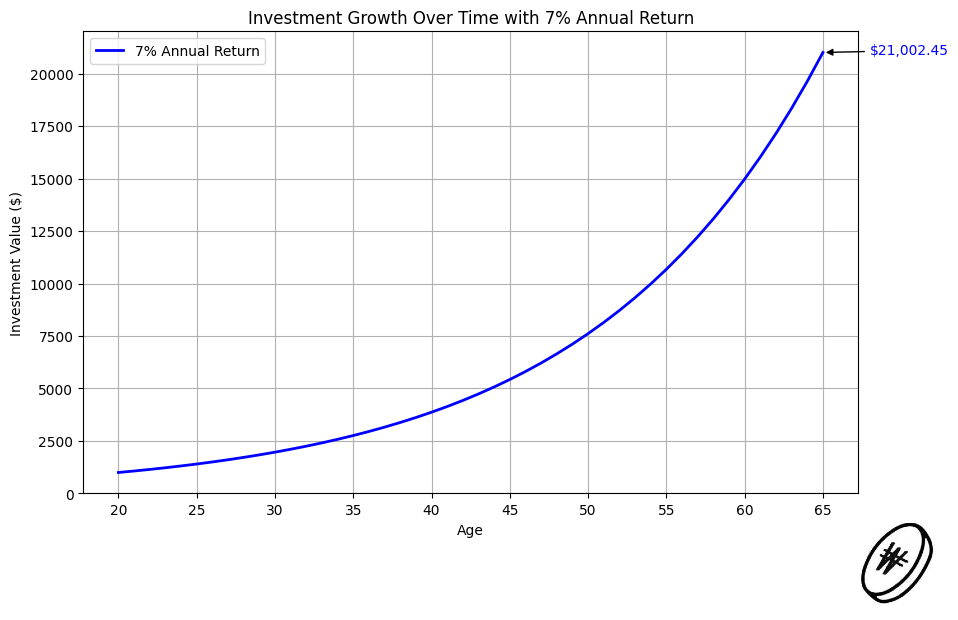

Let’s talk compounding. You’ve probably heard the term tossed around, but here’s the deal: compounding is what happens when your money earns money. Say you put $1,000 into the stock market at age 20. Let’s assume an average return of 7% a year (which is typical for the S&P 500 historically). By age 65, that $1,000 will have turned into a little over $21,000!

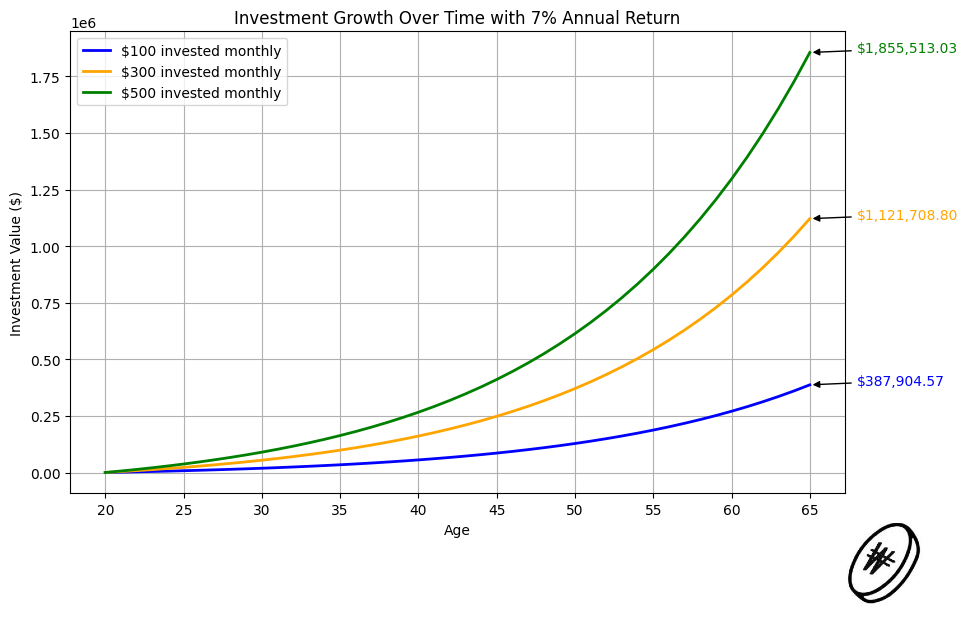

That’s a 2100% return on investment, for nothing more than investing at a young age and keeping the investment for a long time. Now, imagine if you add a few hundred dollars every month to that? Over time, those little contributions could grow into hundreds of thousands, or even millions.

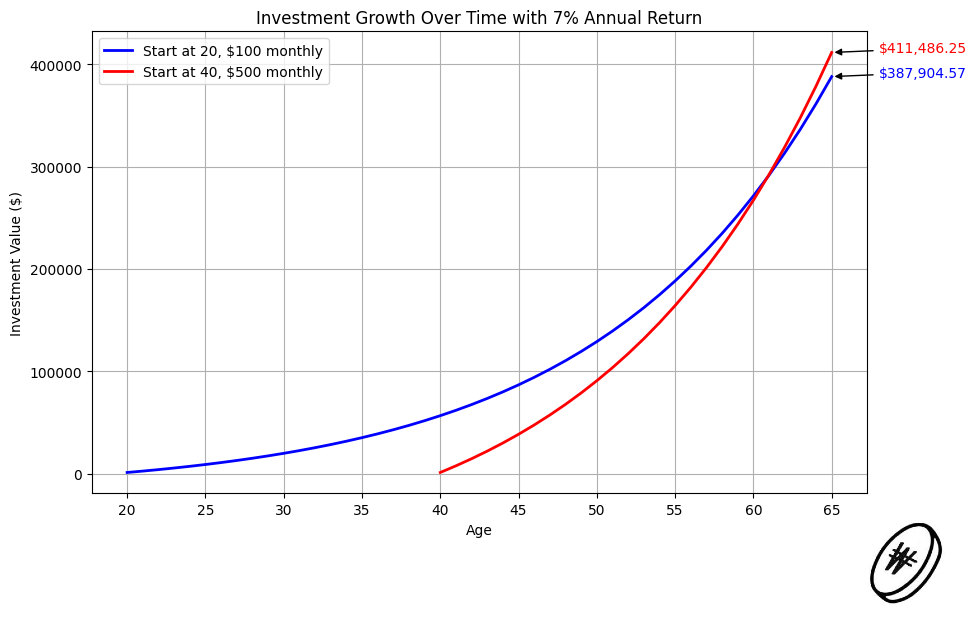

If you’re thinking, “I’ll just wait until I make more money,” consider this: waiting until you have ‘perfect finances’ can drastically affect your potential returns. Suppose someone invests $100 a month starting at age 20 versus $500 a month starting at age 40. By age 65, those extra decades of investing could mean that even though person B invested $500 every month since the age of 40, they would still have about the same account value as someone who invested only $100 a month since age 20, all thanks to compounding. The earlier you begin, the more time you give compounding to work its magic.

Consistency also matters just as much as starting early. Think about it like working out. A single intense workout won’t make you fit, but consistent exercise over time will. It’s the same with investing. Regular contributions, no matter how small, add up over the years. Even if you can only put away $50 a month, do it consistently. Studies show that people who invest consistently and over the long haul generally perform better than those who try to time the market with larger, lump-sum investments.

One big thing that holds people back from investing is the misconception that it requires thousands of dollars to start. Today, thanks to online brokers and apps, you can begin investing with as little as $5. And thanks to fractional shares, even high-priced stocks like Amazon or Tesla are accessible. Commission-free platforms like Robinhood or WeBull make it easy to start small and go steady.

Another way to look at it is through the concept of dollar-cost averaging (DCA). With DCA, you invest the same amount consistently, regardless of market conditions. When the market is down, your money buys more shares. When it’s up, you buy fewer shares but gain on previous investments. This takes the pressure off trying to “buy low and sell high,” which, let’s be real, is tricky even for the pros.

Now, if you’re still in your early 20s or even late teens, there’s a golden opportunity to start growing wealth with the added advantage of time. A recent study by Vanguard found that investors who started in their 20s had nearly twice as much in retirement savings as those who waited until their 30s. But what if you’re a bit older and haven’t started yet? No stress! Starting now is still better than waiting another year. Just increase your contributions slightly to make up for lost time. Even if you’re in your 30s or 40s, investing consistently for a couple of decades can still yield substantial returns.

Here’s a real-life example: Warren Buffett, arguably one of the world’s greatest investors, earned most of his wealth after turning 50. However, he started investing at 11! That’s why he’s worth billions now. The lesson? Early investments compound into something massive over time. And for us regular folks, starting early with even a little can add up to life-changing amounts.

Now, let’s talk mindset. Consistent investing requires discipline. Skipping a month because of unexpected expenses is fine, but aim to get back on track. Think of investing as an automatic part of your financial life, like paying rent or bills. Setting up auto-transfers to a brokerage account can help remove the temptation to spend instead of invest. Of course, everyone has financial goals unique to their situation. You might want to retire early, travel, or just have peace of mind. Regular investing can support these goals, especially if you keep a mix of diversified assets. Diversification spreads risk across different investments, reducing the chances of a single bad bet derailing your progress.

The stock market isn’t the only option, either. You can look into bonds, real estate, or even invest in your retirement through a 401(k) or IRA if available. Especially with 401(k)s, take full advantage of any employer match. That’s free money!

Investing isn’t a sprint; it’s a marathon. And with a marathon, it’s all about pacing yourself. The goal is to stay in the race, no matter what. Markets will fluctuate, but staying consistent and not panicking during downturns will pay off. Historically, the S&P 500 has seen an average annual return of about 7-10%, and it always recovers from dips. To wrap it up, starting early and staying consistent might be one of the most rewarding financial moves you can make. The power of time and compounding can turn even modest contributions into significant wealth over the decades. So, even if it’s $50 a month, start today and stick with it. Your future self will thank you!